Consolidation effect shows patients increasingly navigate to larger, established operators as industry matures

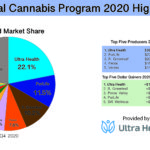

(Albuquerque) – Combined patient sales from the 34 licensed producers in New Mexico’s Medical Cannabis Program totaled $203 million in 2020, an increase of $74 million or 57% over reported patient sales in 2019. Ultra Health, New Mexico’s #1 Cannabis Company, led all operators with nearly $40 million in patient sales, 71% greater than its nearest competitor.

Patient enrollment grew by 30% during the same period, from 80,257 patients as of December 31, 2019, to 104,655 patients as of December 31, 2020, according to data published by the New Mexico Department of Health (NMDOH). The 24,398 patient enrollment gain in 2020 was the single largest jump since the inception of the program.

The industry experienced unprecedented gains in patient sales and enrollment during 2020, largely in part to increased demand spurred by the COVID-19 pandemic. Patients continued to shift to the top five providers, indicating a consolidation effect in the industry.

2020 BREAKDOWN

Altogether, New Mexico’s top five providers accounted for 55% of reported patient sales in 2020, an increase from 49% the previous year. The top 10 out of 34 total providers accounted for 74% of total patient sales in 2020.

2020 Revenue 2019 Revenue $ Increase % Increase

|

$39,522,044 | $19,750,988 | $19,771,056 | 100% |

|

$23,120,494 | $15,944,288 | $7,176,206 | 45% |

|

$20,978,619 | $11,888,647 | $9,089,972 | 77% |

|

$16,075,150 | $7,338,780 | $8,736,370 | 119% |

|

$11,403,356 | $8,394,441 | $3,008,915 | 36% |

| Total Industry | $203,471,624 | $129,258,236 | $74,213,388 | 57% |

Three of the top 5 providers grew to their size organically while two combined operations with other licensees to achieve their industry presence. PurLife combined operations with MJ Express-O, absorbing three retail stores in 2018. R. Greenleaf combined operations, including the addition of two retail stores, with the Medzen license in 2016.

Nine operators exceeded the industry’s year over year growth pace of 57%, and 25 providers fell below the industry pace.

The 34 providers sold a total of 31,434 pounds of medical cannabis flower, an increase of 43% over pounds sold in 2019. Compared to the patient enrollment gains of 30%, it is evident that not only is the patient population expanding, but existing patients are purchasing more cannabis per member in 2020 than years prior.

The gain in pounds sold is largely due to increased demand due to the COVID-19 pandemic. New Mexico patients began purchasing substantially more cannabis in March 2020, and those purchasing patterns continued throughout the fourth quarter of the year.

The price of cannabis stayed practically the same from 2019 to 2020. The average price per gram dropped to $10.23 in 2020 from $10.40 in 2019. The median price per gram dropped to $9.61 in 2020 from $10.02 in 2019.

The New Mexico industry continues to struggle with cannabis care affordability. The regulator has artificially capped the number of plants providers may cultivate and restricted purchase limits far below industry standards despite the statutorily-created Medical Cannabis Advisory Board recommending increases to both allotments and ongoing litigation.

It is unclear why the regulator enforces such scant restrictions on the program, especially in light of overregulation being tied to increased illicit market activity. In addition, illicit market activity has been shown to drive crime in the Albuquerque area.

Furthermore, the industry’s overregulation and programmatic restrictions are likely to see some relief if not complete erasure due to the New Mexico Legislature considering multiple bills to legalize cannabis for adult use in the 2020 Legislative Session.

REGIONAL ANALYSIS

Surrounding states’ cannabis industries continue to outshine New Mexico’s performance.

In Arizona, voters approved Proposition 207 in November 2020, legalizing cannabis for adult-use. The state began licensing operators and allowing adults to purchase cannabis just 80 days after voters approved the initiative. Arizona adults are now legally allowed to purchase a maximum of one ounce of cannabis per transaction from regulated sources.

Currently, there are just 1.37 dispensaries per 100,000 people to serve both adult-use consumers and medical patients in Arizona’s largest city, Phoenix. New Mexico is already poised to support adult-use cannabis at the retail level, as Albuquerque has 8.37 dispensaries per 100,000 people according to the most recent data released by the New Mexico Department of Health (NMDOH).

In 2020, both Arizona and Oklahoma operated as medical-only cannabis states that significantly outperformed New Mexico’s medical-only activity.

| Medical-Only State | New Mexico | Arizona | Oklahoma |

| Total patients (Dec. 2020) | 104,655 | 295,295 | 367,053 |

| Total population | 2.1M | 7.3M | 4.0M |

| Patient % of population | 5.0% | 4.0% | 9.3% |

| Purchase limits (90 days) | 8 ounces | 15 ounces | 270 ounces |

| Plant caps | 1,750 per producer | NONE | NONE |

| Total dispensaries | 122 | 135 | 2,057 |

| Qualifying conditions | 28 | 13 | Anything physician-approved |

While New Mexico has a robust retail network of 122 dispensaries statewide, the state will have the biggest challenge providing enough cannabis to absorb both patient and adult-use demand once the state legalizes cannabis for adults. Currently, the regulator has the opportunity to lift arbitrary caps on production through the Emergency Rule process.

If an Emergency Rule is implemented, current medical cannabis producers will be able to immediately expand their cultivation capacity. On average, the life cycle of a cannabis plant is 129 days, indicating producers will need about four and a half months before new cannabis products are available for retail or wholesale distribution.