Third-quarter patient sales up 62% over same period last year, COVID-19 continues to impact demand

(Albuquerque) – Combined patient sales from the 34 licensed producers in New Mexico’s Medical Cannabis Program totaled $55 million for the third quarter of 2020, an increase of $21 million or 62% over reported patient sales in the third quarter of 2019. Ultra Health topped all producers in the quarter with $12 million in patient sales.

The program enrolled 98,507 patients as of September 30, 2020, an increase of 27% over September 2019 enrollment. A total of 8,565 pounds of cannabis flower was sold to patients during the third quarter of the year, representing an increase of 41% over total pounds sold in the third quarter of 2019.

The increased demand experienced through the third quarter of 2020 indicates the COVID-19 pandemic continues to exacerbate medical cannabis shortages in New Mexico’s program identified earlier this year.

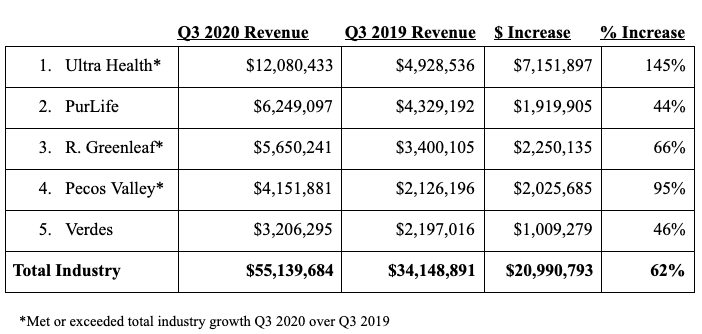

New Mexico’s top 10 cannabis providers accounted for 74% of total patient sales. The industry’s top providers’ patient sales for the third quarter of 2020 over 2019 include:

*Met or exceeded total industry growth Q3 2020 over Q3 2019

Patients have been consistently migrating to the program’s top cannabis providers quarter after quarter, indicating the industry is consolidating toward larger, more established cannabis operators. Of the nearly $21 million of new quarterly revenues, over 70% was derived from the top five producers alone. Ultra Health’s $7 million revenue increase for the quarter matched the total of the next top four competitors combined.

In the third quarter of 2017, the top 5 and top 10 cannabis providers accounted for 41% and 62% of total patient sales, respectively. In the third quarter of 2020, the top of and top 10 providers accounted for 57% and 74% of total sales, respectively.

Twenty of the total 34 licensed producers grew slower than the total market from the third quarter of 2019 to the third quarter of 2020 due to the inability of said operators to absorb patient demand.

“Today’s cannabis market is teaching us much about resiliency, adapting and rapid growth. But most importantly, the greatest lesson is about inclusiveness. We are in this together and each day provides a new opportunity to better serve. The new normal is, be bitter or be better,” said Duke Rodriguez, CEO and President of Ultra Health®.

REGIONAL ANALYSIS

On November 3, 2020, Arizona residents voted to legalize cannabis for adult use. The measure allows adults to purchase and possess 1 ounce of cannabis and cultivate up to 6 plants for personal use at home. Adult-use cannabis sales could commence as early as March 2021. New Jersey, Montana, and South Dakota also approved ballot measures to legalize cannabis for adult use, and South Dakota and Mississippi approved measures to legalize cannabis for medical use.

New Mexico is now landlocked between three states with more flexible cannabis policies than its own. Legalization in Arizona is likely to create greater momentum surrounding legalization of cannabis for adult use in New Mexico during the 2021 Legislative Session.

New Mexico’s medical and adult-use cannabis market is estimated to generate $600 million in consumer sales and $90 to $100 million in recurring tax revenue. The path to a legalization market of such size will require legislators and regulators to work collectively to create a robust cannabis model.

The model would require purchase limits that allow patients and adults to purchase cannabis in amounts that fit their needs, elimination of arbitrary plant limits that would limit the overall industry’s performance, open licensing to allow micro businesses and other new entrants to participate in the industry, and a generous lead time to allow current licensees to begin growing more plants before adult-use sales commence.