Patients choose Ultra Health by 6 to 1; Industry hampered by regulatory hurdles

(Albuquerque) – Combined patient sales from the 35 licensed producers in New Mexico’s Medical Cannabis Program totaled $106 million in 2018, an increase of $19.6 million or 23 percent over reported annual revenue in 2017.

Patient enrollment grew by 45 percent over the same period, from 46,645 patients as of December 31, 2017, to 67,574 patients as of December 31, 2018, according to data from the New Mexico Department of Health (NMDOH).

The enrollment gain in 2018 grew at nearly twice the pace of patient sales, resulting in the lowest available plant per patient ratio in the program’s history of less than ¼ plant per patient. This trend confirms the plant count limit, coupled with regulatory hurdles, are directly responsible for the lack of an adequate supply statewide.

Patient access restrictions in the program include scant purchase limits, potency caps, failure to honor reciprocity with other states and the prohibition on producers to provide savings to patients for volume purchases. All of these factors, along with a restrictive plant count, contribute to a low program utilization compared to the region, inflated prices for patients, and increased black market marijuana activity.

The program is expected to address the medical cannabis shortages experienced over the past years, as Governor Michelle Lujan Grisham specifically campaigned to eliminate plant caps.

The last study completed by the NMDOH on demand was 2013 when they found 9,760 patients’ needs were being grossly unmet. Since then, patient enrollment grew by 531 percent as of December 31, 2018, and the dire need for an adequate supply of medicine has worsened considerably.

2018 BREAKDOWN

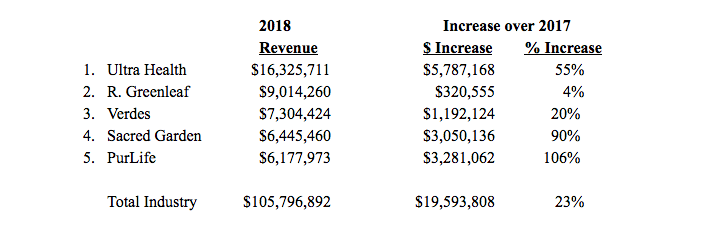

The 35 licensed producers reported total patient sales of $105.8 million for the year, an increase of 23 percent over the $86.2 million in revenue achieved in 2017. While the industry revenue grew at a 23 percent pace in the aggregate, over three-quarters of the total revenue gain can be credited to the top five producers in the state.

Altogether, the industry’s top five providers accounted for 43 percent of the reported revenue in 2018. Only twelve providers grew faster than the industry’s 2018 revenue pace, and 23 producers fell below the industry pace. Nine providers managed to grow at levels that outpaced the 2018 patient enrollment increase of 45 percent.

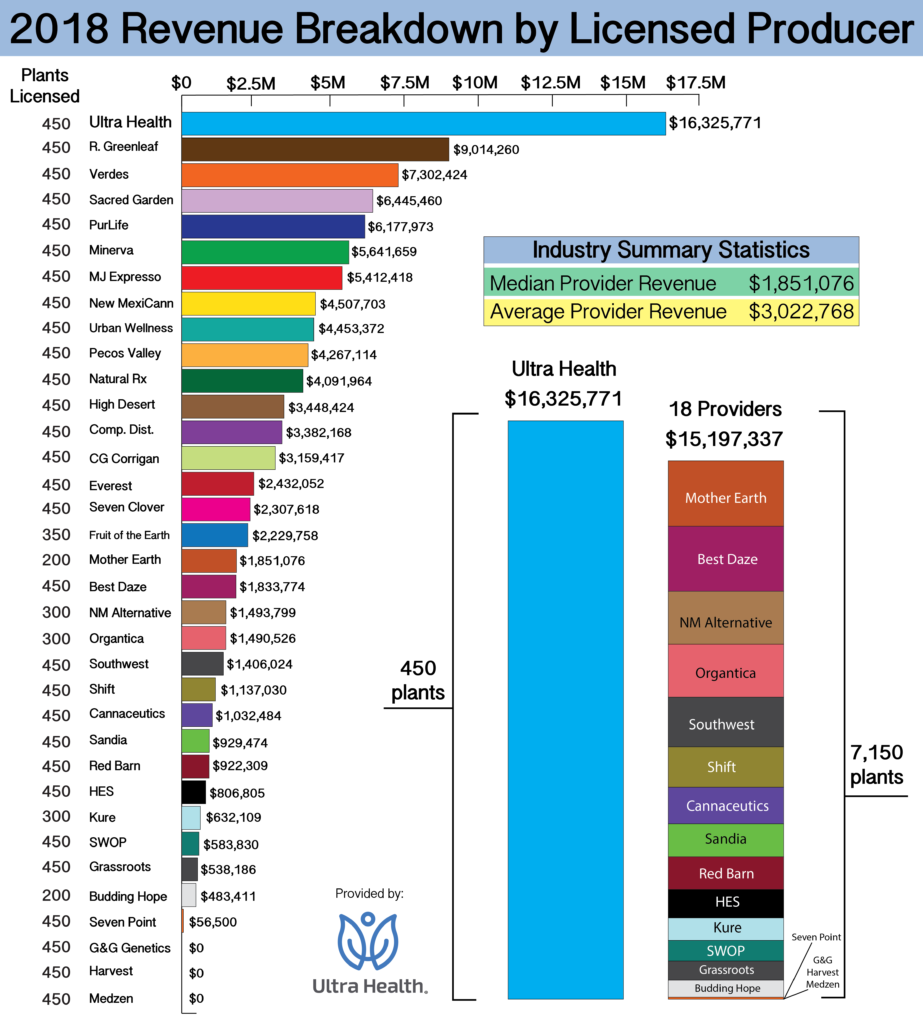

While Ultra Health’s nearest competitor lags by 81 percent, the average patient sales among the remaining 34 providers trails even further at less than $2.7 million per operator. New Mexicans are selecting Ultra Health as their preferred provider for cannabis care by over 6 to 1.

Ultra Health’s statewide market share grew from 12.2 percent in 2017 to 15.4 percent in 2018, and the provider is serving 13 New Mexico counties. Ultra Health’s patient revenue was greater than 18 licensed producers combined in 2018.

The average producer revenue in 2018 was $3 million, while the median was $1.8 million. Twenty-one producers fell below the industry average, again confirming a strong migration in patient choice toward the industry’s top providers.

The average price per gram in 2018 was $10.01 per gram and the median price was $10.02 per gram. Producers reported a total of 7,460,928 grams or 16,433 pounds of cannabis flower sold.

At the end of 2018, statewide supply levels of medical cannabis were the lowest they’ve been in the last two years. The program had an in-stock equivalent inventory of a 6-day supply for all 67,574 patients as of December 31, 2018. At the end of 2018, supply levels were nearly half of what the program experienced at the end of 2017.

“Surpassing $100 million is a great milestone for the Medical Cannabis Program,” said Duke Rodriguez, CEO and President of Ultra Health®. “However, the industry would have exceeded $212 million if patients were able to purchase an adequate supply of cannabis as allowed for similar patients in Arizona and Colorado. We intend for 2019 to be the program’s biggest year yet, but we also realize fundamental fixes must be made for New Mexicans to fully access the beneficial use of cannabis as mandated by the Lynn and Erin Compassionate Use Act.”

While patient enrollment grew by 45 percent from December 31, 2017, to December 31, 2018, the total cannabis sold legally in New Mexico only increased by 10 percent during the same period. This disparity in growth rates strongly indicates patients are being forced to seek medicine outside of licensed providers due to limitations on production.

Neighboring medical-only state Arizona saw patient enrollment grow from 152,979 patients to 192,303 patients from 2017 to 2018, an increase of 26 percent. Comparatively, the total pounds of cannabis sold grew from 86,637 pounds to 121,915 pounds, an increase of 41 percent, during the same period. This growth ratio of patient enrollment to total pounds of cannabis sold is an example of how a thriving, vertically-integrated medical state operates with an adequate supply of medicine statewide. Arizona does not enforce any plant count cap or potency limits while allowing for volume discounts and two times the purchasing limits in New Mexico.

2019 OUTLOOK

As the Medical Cannabis Program begins to mature, patients will be relying more heavily upon the fully vertically integrated cannabis operators.

The Lynn and Erin Compassionate Use Act envisioned a vertically integrated program by exclusively granting licensed producers the power “to produce, possess, distribute, and dispense cannabis.”

By fully integrating services, providers can offer patients lower prices, expanded access, and continuity of care. Moving forward, retaining the vertically integrated powers mandated by the Lynn and Erin Compassionate Use Act will be paramount in preserving the Medical Cannabis Program.

Proposals to improve access to the program will likely be addressed either in regulation or in statute. Currently, changes to the Lynn and Erin Compassionate Use Act are being contemplated by the Legislature. A bill regarding the legalization of cannabis for adult use has also been introduced for this 60-day Legislative Session.

The Medical Cannabis Program will likely see the addition of new qualifying conditions which will impact demand and enrollment. Governor Michelle Lujan Grisham stated she will direct officials at NMDOH to add opioid use disorder as a condition for medical cannabis treatment. When approved, opioid use disorder will be the first new condition added for medical cannabis treatment since 2013.

Under the current program design, the Medical Cannabis Program’s total industry revenues are projected to reach $131 million by the end of 2019. Patient enrollment is expected to skyrocket to a whopping 87,500 cardholders during the same period.

While this will be the most patient activity the industry has seen to date, significant regulatory challenges are hindering the Medical Cannabis Program’s ability to fully meet patient demand. If the program allowed patients to fully access medical cannabis as states such as Arizona and Colorado have done, the industry could easily achieve over $290 million in medical sales by the end of 2019.

“Whether it’s for physical, mental or social wellbeing, every adult presenting themselves should have the full legal right to choose the cannabis products they need, in the quantities they want, from the provider they prefer and at a price they can afford,” said Duke Rodriguez, CEO and President of Ultra Health®. “There should be no settling for less when it comes to good health.”