Enrollment up 46 percent, patient sales up only 27 percent, restrictions on supply dampens sales

(Albuquerque) – The New Mexico Medical Cannabis Program patient revenues from the first quarter of 2018 reached a new quarterly record of $24.1 million, an increase of 27 percent over the first quarter of 2017 according to new reports released by the New Mexico Department of Health (NMDOH).

For the third consecutive year, Ultra Health, New Mexico’s #1 Cannabis Company, led all 35 licensed producers with more than $3.7 million in patient sales in the first quarter, which is a whopping 90 percent higher than its revenues in the first quarter of 2017.

Patient enrollment reached 50,954 active cardholders as of March 31, 2018, a 46 percent increase from March 31, 2017. The program added over 4,300 new patients in the first quarter.

The significant lag in the rate of patient sales growth as compared to the exponential enrollment increase continues to validate the squeeze on available supply. The declining pace of patient sales behind enrollment growth also suggests slippage of regulated cannabis sales into the marijuana black market.

“Cannabis is foremost about compassion,” said Duke Rodriguez, CEO and President of Ultra Health®. “A commitment to compassion means a healthy marketplace that respects choice and fully guarantees an adequate supply of safe, affordable and accessible medicine to meet every patients’ needs.”

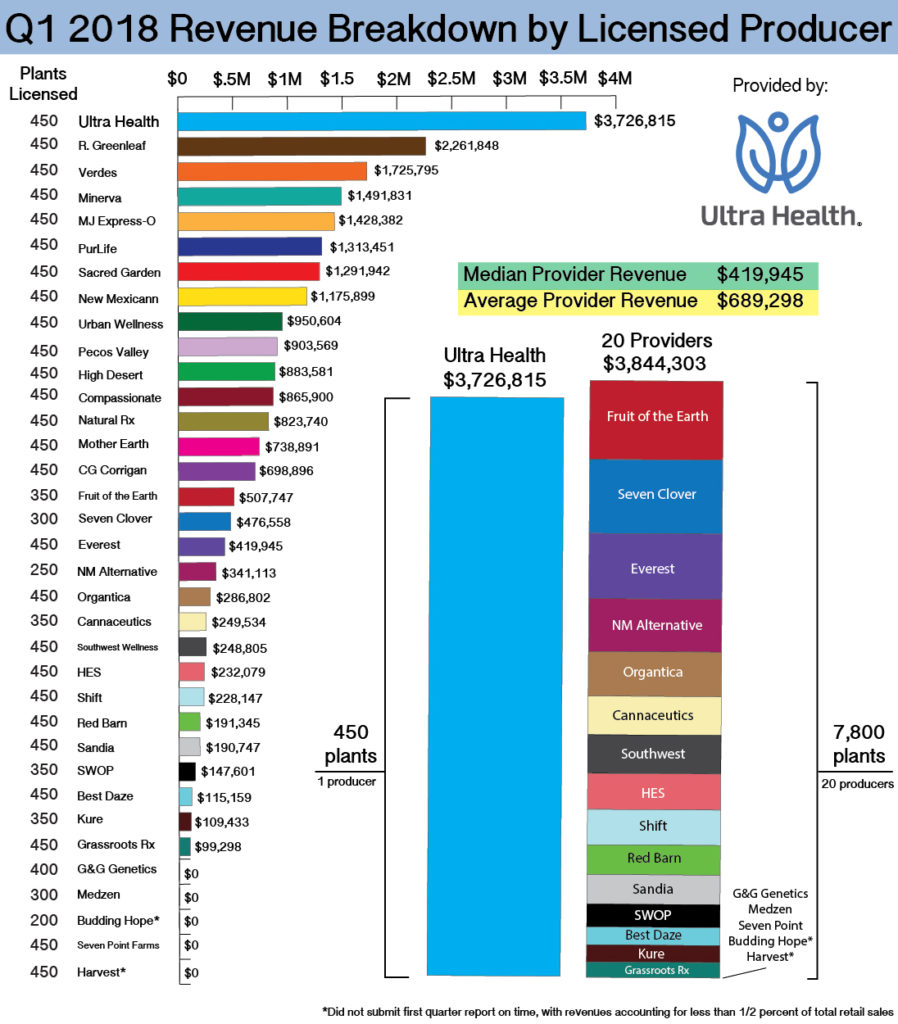

FIRST QUARTER PROVIDER BREAKDOWN

Patient sales include cannabis flower, concentrates, edibles, topicals and other accessories. The single largest retail product is cannabis flower with a reported 1,556,166 grams or 3,427 pounds sold in the first quarter. The average price per gram was $10.35 which is one of the highest prices in the western U.S. as reported by the 2018 Cannabis Price Index.

As the decade-old New Mexico Medical Cannabis Program matures, the leading competitors are strengthening market share which likely will accelerate consolidation in the industry. The top five providers in the state accounted for 44 percent of total patient sales in the first quarter of 2018 versus 38 percent in the same quarter of 2017.

The top five providers reported the following first-quarter patient sales:

- Ultra Health – $3,726,815

- R. Greenleaf – $2,261,848

- Verdes Foundation – $1,725,795

- Minerva Canna Group – $1,491,831

-

MJ Express-O – $1,428,382

The next five providers of medical cannabis accounted for an additional 23 percent in patient sales, with the top ten providers accounting for 67 percent of total first quarter retail revenues.

For the quarter, retail sales averaged $689,298 per producer and the median was $419,945.

Ultra Health’s first quarter patient sales for 2018 were equivalent to the combined total patient sales of nearly 20 licensed producers in the same quarter. Five licensed producers reported no retail sales in the first quarter of 2018 but some wholesale activity was reported.

For the first time, producers were asked to report wholesale purchases and sales. Ultra Health led all wholesale purchasers spending nearly $600,000 and buying 160,525 grams for the quarter. G&G Genetics led all wholesalers with $315,500 in sales for the quarter. Wholesale transactions are not counted in patient sales to avoid duplicate reporting.

CONTINUED SHORTFALL OF AVAILABLE MEDICINE

With more than 51,000 patients in the New Mexico Medical Cannabis Program, available medicine still lags behind demand as higher prices continue to burden patients. The medicine shortage was formally confirmed in an NMDOH commissioned survey in 2013 which addressed an already existing shortfall relative to average patient use.

In February 2014, NMDOH announced a proposed plant increase and license expansion to handle the shortage of available medicine. There were 10,621 patients in the program at the time. The changes were touted by the Department of Health as “a plan to meet current and future patients needs.”

The plant count changes did not take effect until April 2015. Subsequently, the plant count cap has remained unchanged while patient enrollment has grown 380 percent, and more than 40,000 active patients have been added to the program.

Ultra Health filed a complaint against NMDOH to ensure an adequate supply of medical cannabis in August 2016. Santa Fe District Court Judge David K. Thomson is expected to rule on the case at 3:00 p.m. on May 30, 2018, in Santa Fe.

Enrollment is expected to reach 65,000 patients by year end, and patient revenues are projected to hit in excess of $105 million in 2018. It is estimated, if the current 35 licensed producers were allowed to grow an adequate supply to fully satisfy medical demand, the sales from 65,000 patients would generate over $228 million annually, more than twice the current projected patient revenues.