Cannabis industry revenues up more than 64 percent over last year.

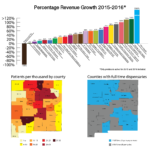

(Albuquerque) – The Medical Cannabis Program’s total industry revenues from 2015 to 2016 increased by $19.7 million, resulting in $50,638,520 and a growth of 64 percent. Cannabis sales significantly surpassed other notable industries. Comparatively, the New Mexico chile crop was valued at $41.1 million in 2015 and the state’s craft beer industry is expected to generate $30 million in 2016.

The last reported New Mexico Department of Health (NMDOH) active patient enrollees was 32,840 as of October 2016, an increase of 76 percent from the prior year at 18,628. The growth in total dollar sales continues to lag behind patient enrollee count, validating an underserved demand attributable to the lack of adequate supply in the marketplace. Enrollee information for November and December 2016 has not been released by NMDOH.

The average price per gram in 2016 was $11.28 per gram and the median price was $10.94 per gram. Total grams sold in New Mexico for 2016 was estimated at 4,628,749 grams or 10,205 pounds of cannabis sold. The last reported demand estimates released by NMDOH in 2013 indicated “supply would need to be approximately 5,110,726.4 grams per year,” to meet the needs of 9,760 patients. Based upon NMDOH data, the most recent patient numbers of 32,840 patients would justify a need of over 17.2 million grams or 37,877 pounds annually.

The top five producers accounted for 43 percent of the total sales in New Mexico. On December 31, 2016 the total cannabis flower inventory on hand for the top five producers was 94,929 grams or 209 pounds. Based upon the top five producers’ 2016 sales experience, the inventory on hand represents a supply of less than 15.4 days or approximately a two week supply. Adequate supply is mandated by law “to ensure the uninterrupted availability of cannabis for a period of three months.”

“While the milestone of exceeding $50 million in revenue is encouraging, it is disheartening we continue to significantly lag behind patient needs,” said Duke Rodriguez, CEO and President of Ultra Health®. “New Mexico has an opportunity to create a true medical cannabis program for other states to emulate. Unfortunately the industry has its hands tied due to burdensome fees and regulations that deny patients from having the most cost effective medication in quantity and potency to suit their needs. Hopefully these longstanding issues will be addressed in the current legislative session.”

2016 MARKET BREAKDOWN:

Data was compiled from the licensed provider reports submitted to NMDOH between 2015 and 2016. Thirty-four producers filed reports by the January 17, 2017 deadline. One producer failed to submit their report as required by NMDOH. Organtica’s (licensed in 2015) report remains outstanding but the licensee was fully operational for less than three months and the results would not materially impact the industry totals.

Of the original 23 Licensed Non-Profit Producers (LNPPs) who were operating throughout 2015 and 2016, nearly all experienced double-digit revenue growth. Eleven producers had revenue growth of 50 percent or more for the period. One producer experienced negative growth, and two others were essentially flat during the period.

Ultra Health led all gainers with a whopping 536 percent increase in revenue over the last year. Ultra Health also led all 35 producers in 2016 with $4.9 million in total sales. The top five producers accounted for 43 percent of total market share, and the next five providers accounted for 27 percent. Combined the top ten producers represented a staggering 70 percent of the market in 2016.

The 12 newest providers, who were licensed in October 2015, accounted for approximately 5 percent of total market share in 2016. The 12 new licensed providers represented a 50 percent increase in the number of new licenses but had little impact in their first full year. Two new producers exceeded $500,000 for the year. Five new producers had limited sales, four had no sales and one failed to report results.

Medical cannabis providers generated over $4 million in gross receipt tax, and paid over $15.7 million in employee salaries for an effective 600 full-time equivalent (FTE) employees. Producers also paid plant license fees of nearly $3 million to the NMDOH to administer the program. The program is fully self funded and provides for a revenue surplus to New Mexico’s budget coffers.

Eleven New Mexico counties experienced triple-digit percent patient enrollment increases from October 2015 to October 2016. Lea County experienced the highest increase at 239 percent. Bernalillo County remains the largest enrollment with 12,285 active cardholders. Sierra County has the highest penetration of enrollees per thousand population with 35 cardholders per thousand population.

Nearly 50 percent of the state’s 47 dispensaries are located in the Albuquerque and Santa Fe area, while 19 counties and 3,574 patients remain without a full time dispensary. The fastest percentage growth in new patients is being experienced outside of the Albuquerque and Santa Fe markets.