Patients choose Ultra Health 6 to 1, top five providers account for half of total patient sales

(Albuquerque) – Combined patient sales from the 34 licensed producers in New Mexico’s Medical Cannabis Program totaled $129 million in 2019, an increase of $23 million or 22% over reported patient sales in 2018.

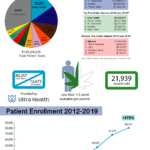

Patient enrollment grew by 19% during the same period, from 67,574 patients as of December 31, 2018, to 80,257 patients as of December 31, 2019, according to data published by the New Mexico Department of Health (NMDOH).

2019 BREAKDOWN

Altogether, the state’s top five providers accounted for 49% of the reported patient sales in 2019 and 60% of the industry’s $23 million of revenue growth recognized from 2018 to 2019.

The following providers with comparable sales in 2018 and 2019 reported the following patient revenue:

| Provider | 2019 Revenue | $ Increase over 2018 |

| 1. Ultra Health | $19,750,988 | $3,425,277 |

| 2. R. Greenleaf | $11,888,647 | $2,874,387 |

| 3. Verdes | $8,394,441 | $1,090,017 |

| 4. Pecos Valley | $7,338,780 | $3,071,666 |

| 5. Sacred Garden | $6,754,279 | $308,819 |

| Total Industry | $129,258,236 | $23,461,344 |

While the other four top providers lag behind Ultra Health by up to 192%, the average patient sales among the remaining 33 providers trails even further at less than $3.3 million per operator. New Mexicans are continuously selecting Ultra Health as their preferred provider for cannabis care by 6 to 1.

The overall average producer revenue in 2019 was $3.8 million, while the median was $2.8 million. Eighteen providers fell below the industry average.

A total of 9,960,605 grams or 21,939 pounds of cannabis was sold on the regulated market in 2019, an increase of 34% over the cannabis sold in 2018.

The average price per gram in 2019 was $10.40 per gram and the median price was $10.02 per gram. The price per gram for medical cannabis has stayed flat since 2014, while other states’ medical cannabis programs such as Colorado have seen medical cannabis flower prices decline by as much as 40%. The consistently high prices in New Mexico’s medical cannabis program can be attributed to unnecessary overregulation on the number of plants a medical provider can cultivate.

The fastest-growing counties with at least 500 cardholders in 2019 include:

| County | December 2019 Enrollment | % Gain over 2018 |

| 1. Otero | 2,917 | 45% |

| 2. Lincoln | 1,046 | 27% |

| 3. Socorro | 799 | 25% |

| 4. Doña Ana | 6,965 | 24% |

| 5. Grant | 1,524 | 23% |

| 6. Sierra | 1,005 | 22% |

| 7. Chaves | 2,558 | 22% |

| 8. Sandoval | 5,750 | 19% |

| 9. McKinley | 787 | 18% |

| 10. Santa Fe | 9,246 | 18% |

The conditions with the most qualified patients enrolled include Post-Traumatic Stress Disorder (PTSD), chronic pain, and cancer, which make up 93% of all patients in the program.

2020 OUTLOOK

Many medical cannabis initiatives in New Mexico are expected to be institutionalized in 2020, which will likely solidify medical cannabis’ place in New Mexico’s healthcare system.

This year will be the first full year for many programmatic changes that normalize the medicinal use of cannabis including plant count, new qualifying conditions, and the removal of the residency requirement for qualified patients.

In 2020, it will be the first full year cannabis providers can grow more than 450 plants each since 2015. The courts ordered NMDOH to promulgate new rules for cultivation in 2019 after former Santa Fe District Court Judge David K. Thomson found the 450 plant cap limit was arbitrary, capricious and frustrated the purpose of the Lynn and Erin Compassionate Use Act in late 2018.

Although NMDOH chose to raise the plant cap to a maximum of 1,750 plants per producer without sufficient evidence, the new cap is unlikely to satisfy the statutory mandate of adequate supply. Patients will continue to pay higher prices for medicine as compared to other medical cannabis states until arbitrary restrictions on cultivation and therefore the supply of medicine are permanently abolished.

In June 2019, NMDOH approved six new qualifying conditions for medical cannabis treatment including opioid use disorder, Alzheimer’s disease, Autism Spectrum Disorder, Friedrech’s Ataxia, Lewy Body Disease, and Spinal Muscular Atrophy.

Since being approved, the six new conditions altogether account for 235 new patients as of December 31, 2019. NMDOH has done little to no outreach to inform those with these conditions they now qualify for medical cannabis treatment.

In September 2019, a Santa Fe District Court Judge ordered NMDOH to allow non resident patients into New Mexico’s program. As of December 31, 2019, out of state enrollees accounted for 421 total patients, more than nine individual counties and 19 individual conditions.

Other changes to New Mexico’s laws regarding cannabis are the legal use of medical cannabis by children in schools and by those who are in custody or under supervision of a state or local government. While these statutory changes were signed into law last year, state agencies still need to make advancements to meet the Legislature’s intent.