Two licensed producers generate half of New Mexico’s cannabis industry growth

(Albuquerque) – The 35 commercial producers in New Mexico surpassed $51 million in patient sales for the first six months of 2018, according to data submitted to the New Mexico Department of Health (NMDOH). The retail patient revenue for the first six months is an increase of 27 percent over the same period in 2017.

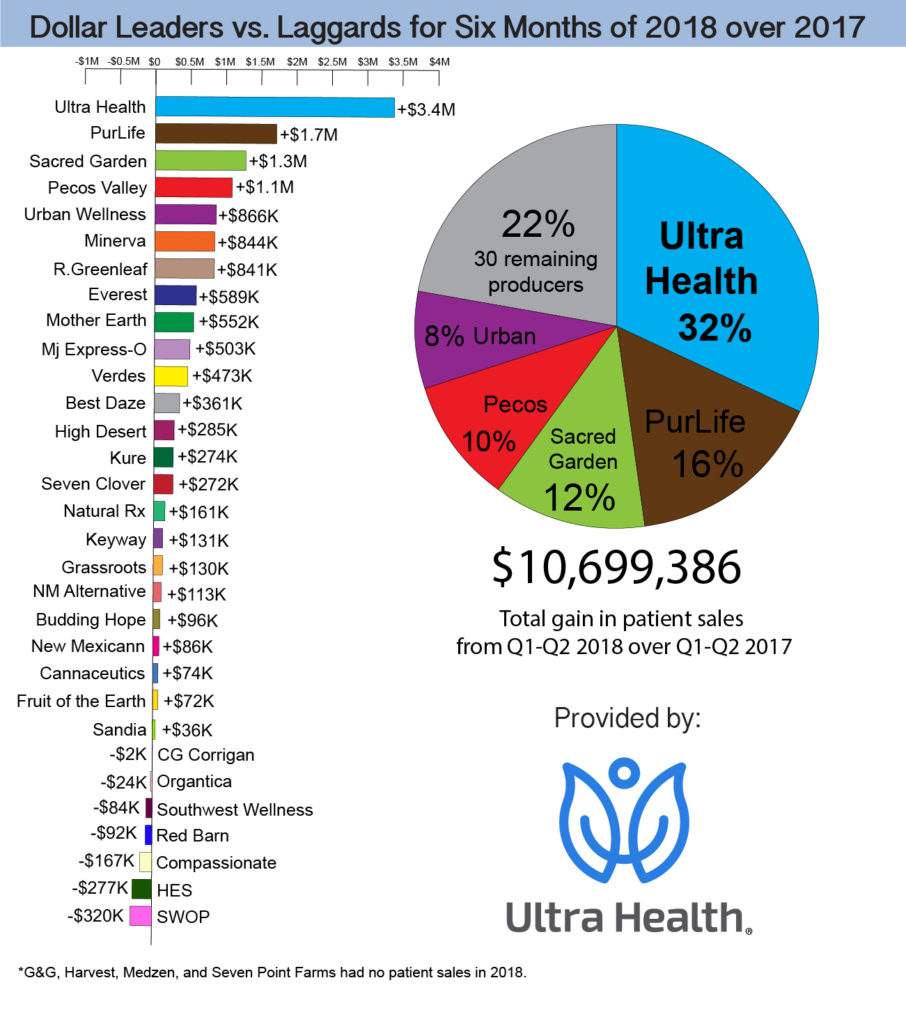

Five providers in the state were responsible for 78 percent of the revenue increase from the first six months of 2018 over the comparable period in 2017, while two of the five producers accounted for nearly 50 percent of the industry’s total growth.

SIX MONTH BREAKDOWN

For the 3rd consecutive year, Ultra Health’s patient sales were ahead of all 34 other licensed providers. Ultra Health finished the second quarter of 2018 with $4.0 million in sales and $7.7 million for the first six months, an increase of nearly 80 percent over last year. The provider has achieved over 15 percent market share statewide and is the only New Mexico producer to ever reach $4.0 million in retail sales in a single quarter.

The top five providers reported the following retail sales in the first six months of 2018 and represent nearly half of the industry’s total patient care for the period:

6 Month Increase over 6-months 2017

Revenue $ Increase % Increase

Ultra Health – $7,700,301 $3,381,227 78%

R. Greenleaf – $4,684,113 $841,615 22%

Verdes – $3,423,489 $472,733 16%

Minerva – $3,076,656 $843,839 38%

Sacred Garden – $2,951,537 $1,280,543 77%

Total Industry – $51,013,317 $10,699,386 27%

The New Mexico medical cannabis industry surged by $10.7 million in the first six months of 2018 versus the comparable period in 2017. Ultra Health and PurLife combined for 48 percent of the statewide new retail business in 2018. Measured alone, Ultra Health’s revenue gain in 2018 exceeded the combined total of over 31 producers’ revenue growth for the same period.

Thirteen providers outperformed the industry’s 27 percent growth rate, while 22 licensed producers fell below the industry pace.

Wholesale transactions are becoming an increasing burden for the cannabis industry. The Lynn & Erin Compassionate Use Act (LECUA) specifically granted licensed producers the exclusive authority “to produce, possess, distribute and dispense cannabis” with no mention of limits on those permitted activities.

In 2013, NMDOH announced a maximum cap of 450 plants allowed per producer, which has prevented the industry from growing sufficient plants to fully meet patient demand and reduce prices similar to neighboring states. The value of wholesale transactions for the first half of 2018 exceeded $4.0 million, which was greater than the six month retail sales activities of 33 out of 35 licensed producers. Thirteen licensed producers purchased 1,158,081 grams or 2,553 pounds of medical cannabis via the wholesale market. Ultra Health and R. Greenleaf accounted for 70 percent of the wholesale purchases reported.

In August 2016, Ultra Health and a qualified patient filed a legal complaint against NMDOH to address the plant count cap and to ensure an adequate supply of medical cannabis for all patients. The matter has been briefed before Judge David K. Thomson of the First Judicial District Court in Santa Fe and the parties are awaiting a decision.

MEDICAL CANNABIS PATIENT ENROLLMENT

Participation in the Medical Cannabis Program as of June 30, 2018 reached 54,857 active cardholders, an increase of 24 percent over the previous year. Patients purchased 7,557 pounds of cannabis for the first six months of 2018, an increase of 12 percent over the same period in 2017.

Because the growth in cannabis purchased from licensed producers is far lower than the growth rate of patients enrolling in the Medical Cannabis Program, it is clear that the state’s licensed producers are unable to totally meet New Mexico patients’ demand for safe and legal cannabis. By failing to allow the state’s licensed producers to fully meet patients’ demand, the Medical Cannabis Program may, in effect, be forcing patients to seek cannabis from the unregulated illicit market.

Cardholders as reported by county are up 43 percent since June 30, 2017. The five fastest growing county enrollments with at least 500 cardholders being:

- Grant 42%

- Otero 32%

- Curry 23%

- Santa Fe 23%

- Dona Aña 23%

Total revenues for the Medical Cannabis Program are expected to surpass $100 million by the end of 2018.

“Providing patients with affordable, safe, and accessible medicine has been the intention of legislators since the inception of the program,” said Duke Rodriguez, CEO and President of Ultra Health®. “Moving forward, success will be defined by the quality of life of the physical, mental and social well-being of each patient rather than merely the number of patients served.”